Why Financial Planning?

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

– Warren Buffet

Financial planning is about bringing the future into the present so that you can do something about it today. If you don’t know where you’re going, you risk ending up somewhere you didn’t intend. A financial plan helps you make informed decisions, keeping you on track to achieve your long-term goals.

A solid financial plan is the foundation for building wealth and creating financial flexibility, leading to greater freedom for you and your loved ones in the future. The three main challenges to building wealth in this country are:

Taxes

Inflation

Spending

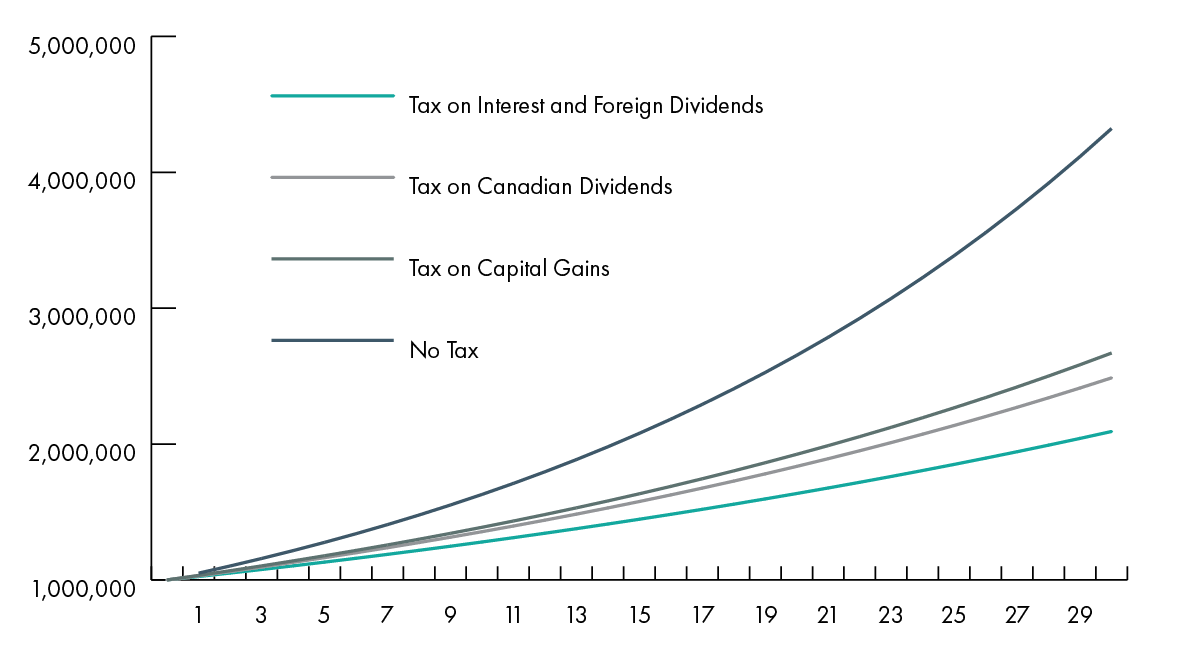

Impact of Tax on Investments earning 5% per year

Tax-efficient Investing

When it comes to investing, most people are too fixated on the return on investment, which isn’t a bad thing in itself, However, more specifically, they should be looking at the net after-tax return on investment. You might be earning a great return on paper, but if those returns are being eroded by investment management fees and taxes then your actual return may be significantly less than you think, and your wealth will accumulate much slower. I have never been one to make investment decisions solely based on tax considerations, but that doesn’t mean you can’t arrange your investments in a more tax-efficient way, ultimately increasing your net after-tax return.

A good financial plan will help you to build a diversified investment portfolio but will also map out where investments are being held to ensure the highest after-tax return. Equity investments have lower tax rates, and should be held in your corporation, while fixed income investments are taxed at higher rates, so they should be held in tax sheltered or tax deferred vehicles like a TFSA or an RRSP. Equity investments create capital gains, which are not taxable until the shares are disposed. This creates a tax deferral while also being taxed at a lower rate compared to interest and dividends. Capital gains realized inside corporations will also create a CDA (Capital Dividend Account), which can be paid out as a tax-free distribution to shareholders.

Corporations earning significant investment income also run the risk of losing their small business deduction, which is the low corporate tax rate (12.2%) on the first $500k of annual active business income. If you have more than $50k per year of investment income in your corporation or any associated corporations, you will start to lose your small business deduction, which will increase your corporate tax rate and significantly decrease your rate of wealth accumulation. There are still creative ways to earn investment income inside your corporation without impacting your small business deduction, but this should be looked at as part of your wholistic financial plan.

Why corporate-owned permanent life insurance for wealth creation?

If there was a way to eliminate tax on investment income, you could accumulate wealth much quicker. One strategy is to use a corporate-owned permanent life insurance policy, which can be overfunded to build cash value. This cash value acts as the investment portion of the policy, earning income like a regular investment account but without being taxed. This means more wealth accumulates in the form of cash value because the returns are not being eroded by taxes. Upon death, the policy pays a tax-free death benefit to the corporation which can then be distributed as a tax-free capital dividend to the estate, effectively converting corporate retained earnings into a tax-free distribution.

People typically look at insurance—auto and home, disability, critical illness and term life—as a risk management tool. These products help mitigate risks at different stages of your life. While they do have their uses, permanent insurance is less about managing risk and more about wealth creation and tax & estate planning. Because it has an investment component and cash value it should be viewed as another asset class, rather than an expense. Like any investment, it can be measured based on your return, risk, liquidity and how it relates to your objectives. In the same way that you would diversify your investment portfolio with cash, fixed income, and equity investments, permanent insurance serves as another asset class in your diversified portfolio, the difference being that it is sheltered from tax.

CASE STUDY:

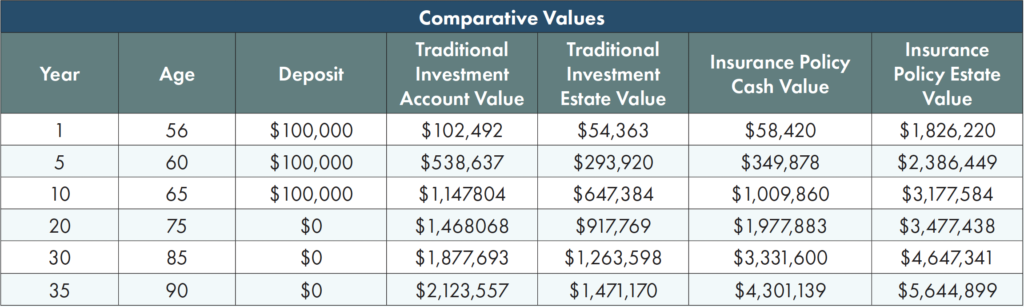

Mr. and Mrs. X invest a small portion of their corporation’s excess retained earnings into a corporate owned permanent life insurance policy rather than a GIC or traditional portfolio investment. In this case we reallocated 2% of their assets, which was less than half of their investment income each year, for 10 years into an insurance policy rather than reinvesting in a GIC.

RE-ALLOCATING $100,000 PER YEAR FOR 10 YEARS INTO A PERMANENT JOINT & LAST TO DIE POLICY VS. A 5% GIC

By reallocating a small portion of their investment assets from a GIC into a permanent life insurance policy, Mr. and Mrs. X were able to transform $1M of corporate assets into $5.64M of estate value, compared to $1.47M of estate value in a traditional GIC, representing additional wealth accumulation of $4.17M to their family. At age 90, this strategy increased their net worth by 19%, decreased their estate taxes by 17% and increased their estate value by 50%. The effective return on this strategy at age 90 is 13.7%, meaning that you would have to invest in a GIC earning an annual return of 13.7% to achieve the same result.

There is a fundamental relationship between return on investment and relative risk level. Generally, the higher the risk the greater the return, otherwise why would anyone take risk? What we have been able to accomplish in this example, is achieve a much higher equivalent return, not by taking more risk but simply by removing taxes, creating significantly more wealth for your family through effective financial planning.

Jeff Murphy, CPA, CMA, MPA

Senior Partner

Darren Rotsch, CPA, CA, MMPA, TEP

Senior Partner