Proper estate planning will ensure that the maximum amount of wealth is being left to your family and not to the government.

Tax-Efficient Corporate Wealth Accumulation

In our experience, estate planning is a topic that many people don’t want to discuss. However, ignoring what you don’t want to deal with doesn’t change things, or make them go away. In fact, it will likely mean a significant amount of your wealth (up to 75% in some cases) could be going to the government in taxes rather than to the people and causes that are important to you. The process of estate planning is not simply about reducing taxes (leaving more) it’s as much about giving you control and direction to whom, when and how your wealth is transferred.

Up to 75% of your wealth could go straight to the government instead of supporting your loved ones or causes you care about.

Let’s look at a simple example…

Let’s look at a simple example of a couple that owns a successful business that ha accumulated $1M in retained earnings in their corporation. Mr. and Mrs. X have other assets to fund their lifestyle and retirement and they plan on investing the money in the corporation and leaving the shares to their adult children. Let’s assume that Mr. and Mrs. X are 55 years old and have a life expectancy of 90 years old. Invested in a GIC earning a 5% return factoring in corporate taxes on the investment income, the corporation would be left with $2,366,327 of cash at age 90.

The Double Taxation Problem on Death

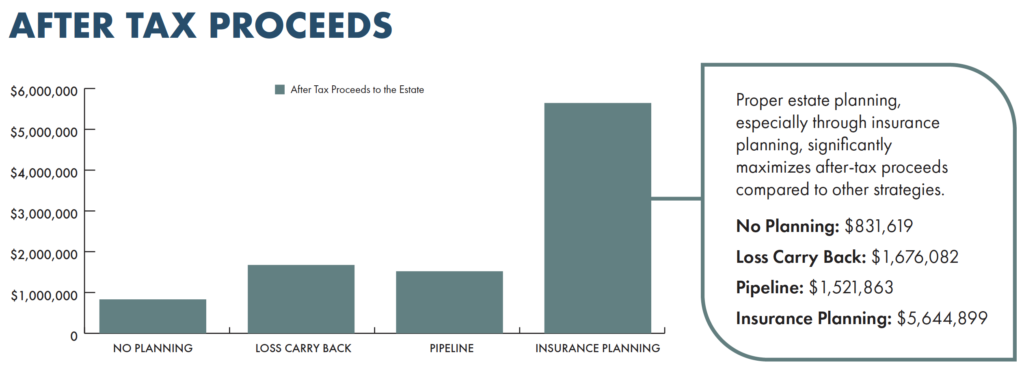

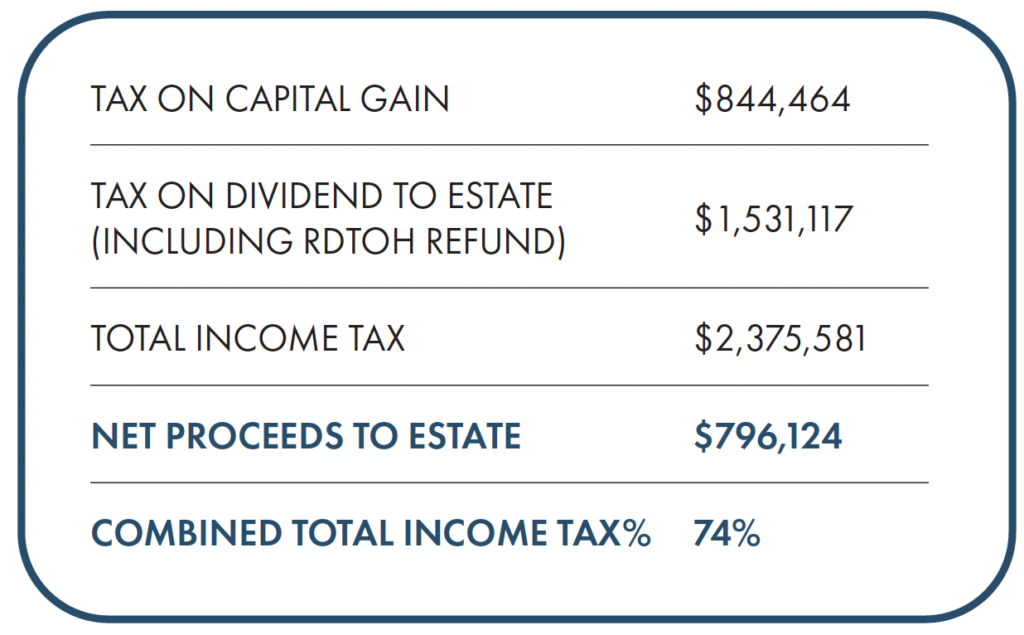

On death all an individual’s assets are deemed disposed of at fair market value, in this case the shares of the corporation are subject to capital gains tax at the current inclusion rate of 66.67% resulting in taxes payable of $844,464. The shares are then transferred to the estate but the cash is still inside of the corporation so the corporation will have to pay a dividend to the estate in the amount of $3,207,200 (which is the cash in the corporation plus the refundable dividend tax on hand generated from the dividend), resulting in additional tax to the estate of $1,531,117, for total income tax of $2,375,581 (74%). If this result seems unfair to you because you are being taxed twice on the same amount, you are correct. This is what is known as the “double tax” on death problem and is typical for anyone in Canada holding shares of a private corporation. The net after tax proceeds to the estate of only $831,619 from the original $3,207,200 of corporate assets. Adding to this could be probate fees of $35,495 if a second will was not created and you have only 25% of the total value going to your heirs.

Estate Planning Post-Mortem

There are two mainstream post-mortem tax planning options to avoid this double tax but neither option is perfect, and they both come with their own challenges. Let’s take a look …

Loss carry-Back strategy

Loss Carry Back involves triggering a capital loss in the estate within the first year of the estate and carrying back the loss to offset against the capital gain on the terminal return, thereby replacing the tax on the capital gain with tax on a dividend. The downside of this strategy is that you are replacing a capital gain at a 35.7% tax rate with a dividend at a 47.7% tax rate. The estate also has to be a graduated rate estate, and this has to be done within the first year of the estate or you will lose your ability to use this planning. In some cases where the corporation has active business assets or assets that are not easily liquidated, like real estate, creating the loss in the first year can be challenging and may result in tax inefficiencies creating double tax.

Pipeline Planning strategy

This strategy involves the use of a holding company to extract funds from the corporation using the adjusted cost base on the shares created by the capital gain on death and creating a tax free intercorporate deemed dividend. This generally results in a lower overall tax because you are paying tax on a capital gain at death rather than a dividend.

It should be noted that this strategy has become less effective as of June 24, 2024 when the department of finance increased the capital gains inclusion rate from 50% to 66.67% thereby closing the gap between the tax rates on dividends and capital gains and eliminating some of the benefit of pipeline planning. There is also a cost benefit analysis because pipeline planning is more complex and generally costs more to implement than a loss carryback strategy.

This strategy is less effective if the corporation has refundable dividend tax on hand (RDTOH) or a balance in the capital dividend account, as these amounts get trapped in the corporation and not fully realized. In our case study, the results of the pipeline are slightly worse than the loss carryback because of the trapped RDTOH so there still exists a layer of double tax on the investment income earned in the corporation that doesn’t get refunded.

There’s also uncertainty and risk tied to postmortem pipelines, as there must be an ongoing business or investment activities that continue for at least one year following the pipeline transaction to avoid the distribution of funds being taxable as a dividend under 84(2). The corporate assets cannot be distributed to the shareholders in the first year and must be done on a gradual basis over an additional period of time, so if there is a desire to access the funds sooner rather than later then a pipeline may not be the answer.

Estate Planning: Pre-Mortem

The most effective way to plan for estate taxes and wealth transfer is during your lifetime. Generally speaking the sooner you engage in planning the better the result but this type of planning can potentially be done for anyone under the age of 80.

Combining this strategy with an estate freeze and implementation of a family trust can further reduce taxes and ensure effective transfer of assets while still maintaining control of the family assets while protecting them from creditors.

Some of these estate planning tools that we currently use to maximize the tax efficiency of wealth transfer could be subject to legislative changes if the department of finance decides that this is too much of an advantage for business owners as they look to generate more tax revenue. In the past, legislative changes in this area have been forward looking only and any policies prior to the change would be grandfathered and still able to enjoy the benefits at the time entered. Looking at the economic outlook and the population distribution, with a large part of our population shifting from tax payers into retirement, the government is going to look for different ways to close the revenue gap and reduce the deficit which is going to result in more tax and some experts are suggesting that this may be an area that they look at which means that you should not wait to do your estate planning.

Let’s look at an alternative solution…

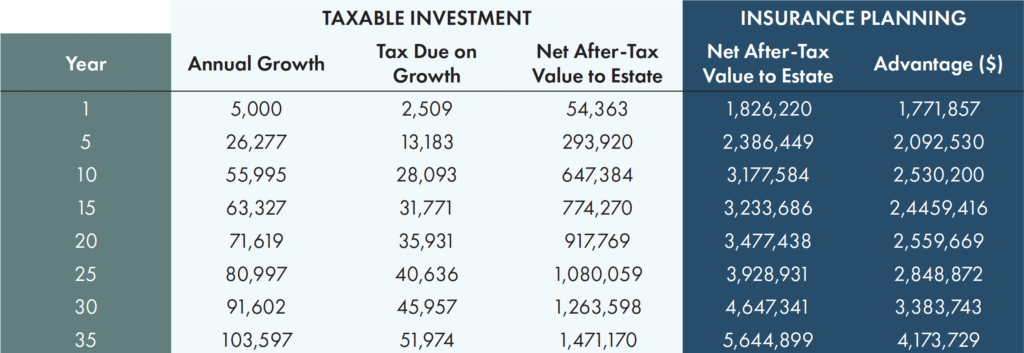

Now imagine that Mr. and Mrs. X take the excess retained earnings in the corporation and put it into a corporate owned permanent life insurance policy rather than a GIC. The advantage of a life insurance policy is that the returns (cash value) grow tax free and would eventually pay out a death benefit to the corporation tax free which would be added to the capital dividend account. These proceeds can be paid out to the estate beneficiaries’ tax free as well. By re-allocating a portion of corporate retained earnings to permanent insurance we have effectively turned corporate retained earnings into a tax free capital dividend, significantly reducing, or in some cases eliminating tax on the transfer. Re-allocating $100,000 per year for 10 years into a permanent Joint & Last to Die Policy vs a 5% GIC.

Multi-Generational Wealth Creation

Taking this wealth creation and transfer strategy one step further we can use this planning to ensure wealth transfer beyond the second generation {G2) to ensure that wealth gets transferred to a third or even fourth generation {G3/G4) in a tax efficient manner creating a multi-generational waterfall. Because of the tax deferred growth and eventual tax-free payout of corporate surplus, effectively planning now for future generations can secure the financial stability of your family for several generations to come.

Jeff Murphy, CPA, CMA, MPA

Senior Partner

Darren Rotsch, CPA, CA, MMPA, TEP

Senior Partner